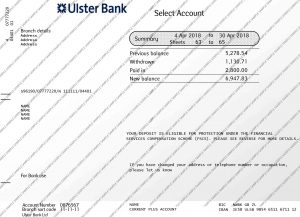

An Ulster Bank statement is a financial document that provides a summary of an account holder’s transactions over a specific period, usually monthly. Here’s what you can typically find in an Ulster Bank statement:

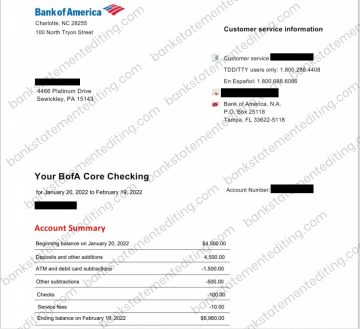

- Header Information:

- Ulster Bank logo

- Account holder’s name and address

- Account number and type (e.g., current account, savings account)

- Statement Period:

- Dates marking the start and end of the statement period

- Account Summary:

- Opening balance at the beginning of the period

- Total deposits made

- Total withdrawals or debits

- Closing balance at the end of the period

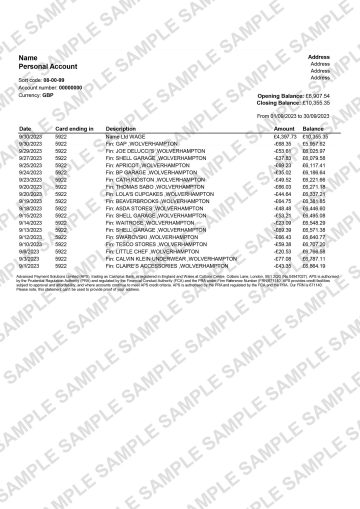

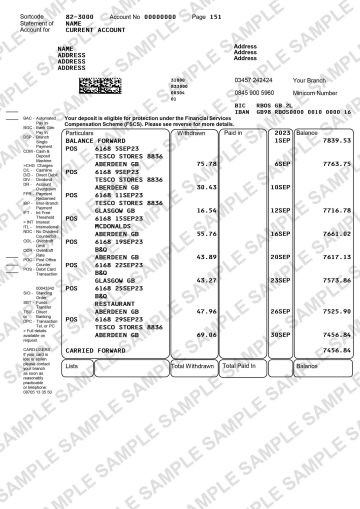

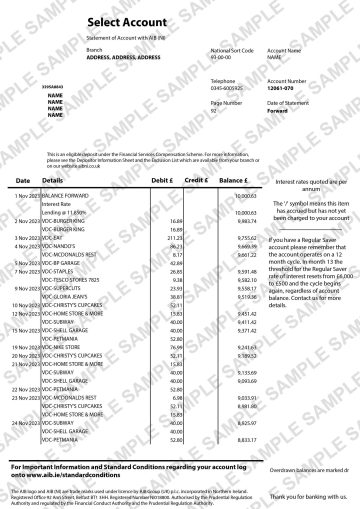

- Transaction Details:

- Date of each transaction

- Description (e.g., merchant name, type of transaction)

- Amount (debit or credit)

- Running balance after each transaction

- Fees and Charges:

- Any service fees or charges incurred during the period

- Interest Earned (if applicable):

- Details about interest rates and amounts earned during the statement period

- Important Notices:

- Updates or notices regarding account terms, changes, or promotions

- Contact Information:

- Customer service details for inquiries or assistance

Ulster Bank statements are essential for personal finance management, budgeting, and tax preparation. Customers can access their statements through online banking or by requesting them at a branch.

There are no reviews yet.